Financial Astrology: Astrology of the US Federal Reserve

Posted by Victoria Reinertsdatter on 21st Nov 2016

Though the actual announcement is an incredible piece of history all in its own right, being as it was one of the first radio broadcasts to be given live at the White House, you’d be hard-pressed to find the original clip of President Woodrow Wilson’s clip wherein he is announcing the establishment and signing of the Federal Reserve Act.

You’d be hard-pressed

to do so because no other singular act in

US History has spawned so much speculation and conspiracy

as this one thing. As I write this, I am going to try REALLY hard to keep it exceptionally factual

rather than speculative, but if you’re not familiar with the fiscal history of

the US, well now you will be in this one particular area and the astrology at play.

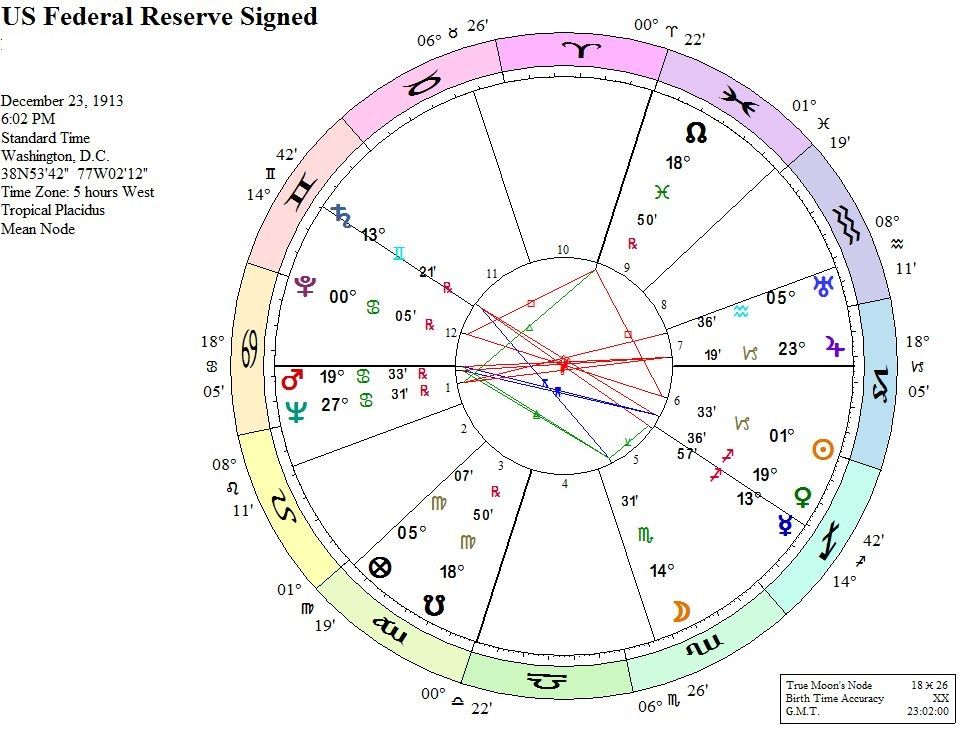

Wilson also indicated that the act would be

signed at a precise time, which makes pulling a chart for that a little

easier. No one’s really sure when it first began operating in terms of the time, but, I tend to think maybe it followed office

hours norms of the time. Still, I approach this from the time most documented

sources state the act was signed into law: 6:02 p.m.

It wasn’t really like this hadn’t been attempted before. Hamilton, then Treasury Secretary actually did get a central bank established in 1791: 1st Bank of the United States. However, No one was really comfortable with it, though it continued on through its 20-year charter until Congress didn’t renew it in 1811. So, a few years later in 1816, bankers were like, “We want to try this again!” and Congress went ahead and threw out the charter for the 2nd Bank of the US. in 1816. President Jackson gets into office in 1828 and says, “Nope” with quite a lot of support behind him (that of the people) and it gets nixed again in 1836.

From about then on out, the US didn’t have a central bank until right around the middle of the Civil War. Here’s where things get a little weird. The young nation is in a state of upheaval, and in 1863, The National Banking Act is passed. This provided for chartering banks on a national level and made sure those notes they circulated were backed by government securities. In addition to this, one of the amendments placed at tax on state notes, but not the national ones. At this juncture, however, the state notes weren’t pushed out because they’d already been doing fine during the time frame where there wasn’t a National Bank and demand deposits continued.

Enter JP Morgan

We talked a little about JP Morgan’s chart already, but

we’ll go into a little more of his impact here because he’s a central figure in

establishing what we know as our financial systems today. Even though the

nation now had a central bank, fiscal ups and downs continued to keep the

economic conditions turbulent. One such financial panic in 1893 started one of

the earliest economic depressions, and the worst the US had seen yet.

We talked a little about JP Morgan’s chart already, but

we’ll go into a little more of his impact here because he’s a central figure in

establishing what we know as our financial systems today. Even though the

nation now had a central bank, fiscal ups and downs continued to keep the

economic conditions turbulent. One such financial panic in 1893 started one of

the earliest economic depressions, and the worst the US had seen yet.

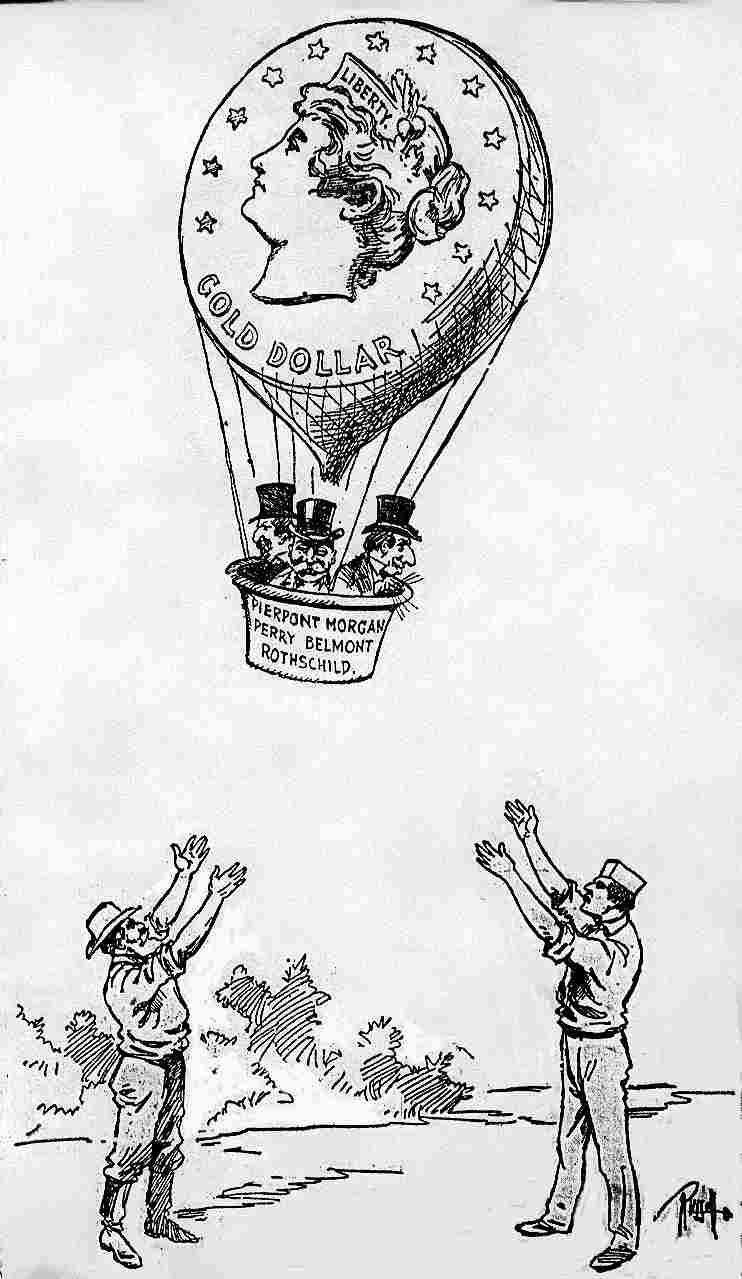

So, here comes JP Morgan. And he’s saved the banks’ skins a couple of times before, but this time, well, he figures this is the time to strike. He may have also been a little tired of putting out fires and searching for a solution, because up until this point: the US Economy was kinda chaotic. So, he comes up with a plan that he felt would not only protect the investments of those who’d sunk their money into the US (himself included), but also he figured this would get other governments to open their coffers and make the people feel a bit more confident about a national currency. President Cleveland wasn’t interested at this point and instead, working with Congress, he began the sales of gold bonds. This didn’t work. So, finally, Morgan goes to Cleveland and says, “There’s this law from 1862, and you could have issued bonds so that people could buy gold without having to go through Congress, you know that, right?” Not even two weeks later, Morgan had already pulled together an international syndicate of bankers, sold the bonds, all of them within 22 minutes, and bought something like 62 million dollars in European gold.

Now, you might think that Cleveland jumped on this… you know, economic Hail Mary pass, right? Except, he didn’t. Much of the government and even MORE of the people were vehemently opposed to this. Once they had gotten what they wanted, the bankers did not protect the president from the nation’s ire. Matter of fact, Cleveland went right under the bus. The reason for this being: the banks made a crapload of money off of this, the people knew it, and somebody had to take the fall. Technically speaking, all he’d done was save the US from the worst economic depression it had experienced, using a solution he wasn’t comfortable with to begin to because he must have felt he had to. Oh and if you didn’t know, at this time, another name you’ve probably heard: The Rothschilds comes into the public vernacular. It was just as bitterly said then as it is now: “The more things change, the more they stay the same.”

Well, though things had stabilized somewhat- for a number of reasons, things were still incredibly tense for the nation. In 1907, Morgan, etc. step in yet again. The nation is incredibly divided at this point because though everyone could agree reforms were needed; nobody could agree on HOW. If you look at the newspaper bits from that time frame, you’ll find that division being exploited by the press even then. (Ads were sold in papers and otherwise, same as they are now.) Whether or not there are unseen hands controlling that press, who knows? Like I said, I’m kinda trying to avoid going into those parts. The young Wall Street of 1907 had really messed up, speculations had gone awry and yet again, a banking panic was happening.

People crowding banks to pull their money out, circa 1907

I may be a bit of a history nerd; please bear with me. So, long story not short at all: people freak out and start pulling all their assets out of various banks. This causes a domino effect: interest rates shot up where the banks were even still lending, but not many were, stocks crashed, and banks failed. Well, Morgan clearly cannot have that, given he’s probably THE Financier at the time. So, he comes back in with his syndicate of bankers. They liquidated the assets of the Trust Company of America before depositors could get all their money out and paid them. This saved the Trust itself, but, it was still on life support, so to speak. So, each president of the major trusts at that time got together. By the end of the night, he had them loaning the 8.25 million the trust needed to stay open another day. The next day, the US Government deposits 25 million into various banks around New York, and another all too familiar name: JD Rockefeller, deposits 10 million more into one of them. For a time, things were still not good and at that time, the nation’s richest bankers: John D. Rockefeller, Lord Rothschild, James Stillman, and JP Morgan kept things afloat with the help of Treasury Secretary George B. Cortelyou. Well, then the US Treasury itself begins to run out of money. For the superstitious out there, finally, a large group of bankers met. 3:00a in the morning on a chilly November night, Morgan locks them into a library and won’t let them out until they agree to what he and the others have come up with. Jacob Schiff, another elite banker, had already set the stage for what was to come by making an impassioned speech in New York foreboding everything that had happened, pushing for a centralized bank.

Finally, in 1913, this happens under Wilson’s presidency: and he, too, much like Cleveland, expressed a lot of concern. Unlike Cleveland, though he did enact and pass it, he was pretty vocal about what this meant for the elite’s control over the country and how he didn’t see it as beneficial to the people. Even back then, there was speculation that the entire thing had been a farce set loose by those bankers to drive the Trusts out of business so they could take control. The ones who didn’t still felt Morgan and the other bankers had at least taken advantage of it. Those involved in the first days of the Federal Reserve? Charles Hamlin, a Democratic attorney, was appointed chairman, Benjamin Strong, a banker and Morgan’s deputy became the Governor of the Federal Reserve Bank of New York, a position he kept for 14 years until his death. This offered him plenty of influence over not just various policies of the Federal Reserve, but the fiscal policies of both the US and Europe.

The two original goals for the Federal Reserve were that it was supposed to prevent the bank failures that had already plagued the nation and also, keep currency and price stability in the country.

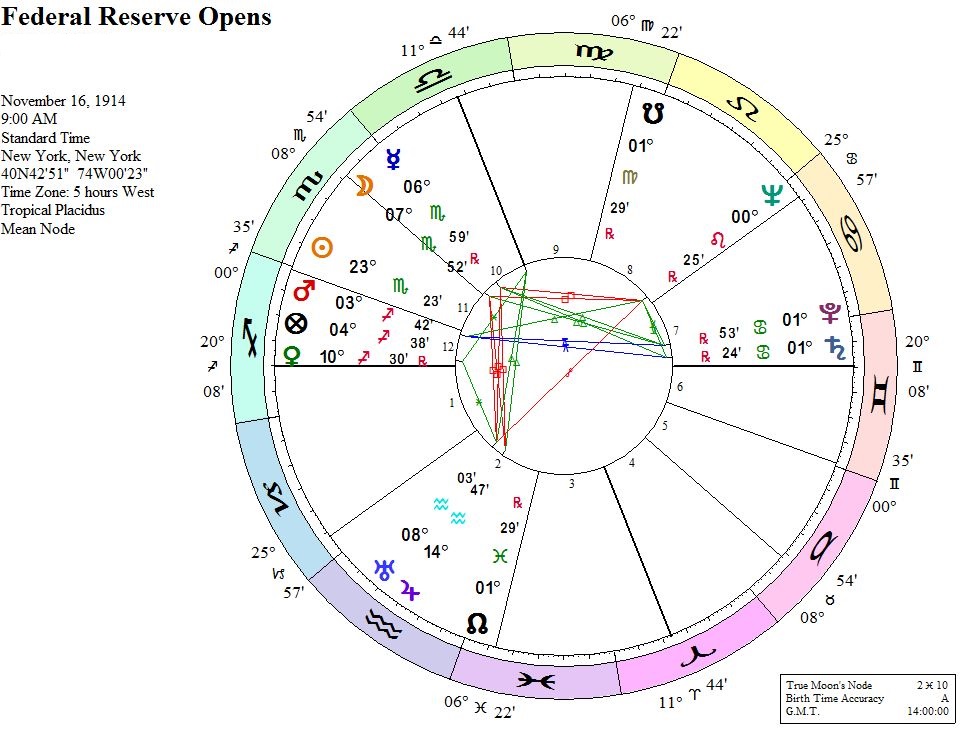

You know what they say about good intentions. So, moving into the astrology here: and well, you can’t have Plutocracy without Pluto. Certainly, the big standout here is a T-Square involving the Sun, Pluto, and Midheaven of this chart. Pluto happens to be in the 12th, which is where all the secrets hang out- so, what we’ve got here, is a chart that immediately screams manipulation. A rise to power that comes across as something it’s not in order to hide said rise.

Remember what I told you about empty houses? If we look at the house that Pluto rules, now the 5th, you’ll find it’s empty. But, picking apart the T-square a bit, we look at both that 5th and the 2nd house in a way. This being the house ruled by the Sun. That rulership and the aspects here show how the Federal Reserve was able to use the open market to take control of the currency.

The Press, Again

So, now, we kind of have to wonder, if so many people were worried, how’d this happen? Obviously, the young country’d had some considerable ups and downs, a lot of panic. A Civil War issues with industry, steel, the railroad boom, and falter. If you look at the Neptune placement, it becomes very obvious. The Federal Reserve, situated in New York, run by New York bankers, mostly happened by slight-of-hand and media manipulation. The date is no accident, but it wasn’t astrology-based. All the lawmakers who’d oppose it just about were already out for the holidays. As I mentioned before, there had already been plenty of press dedicated to it from the time of the Presidential elections the year before onward.

Inflation, Deflation and Neptune

I was going to use a graph that shows the spikes and otherwise economically, but the date range I was working with was too big to include in just one graphic. What it shows, however, is that alongside Neptune’s transits: we see changes in inflation or deflation based on Jupiter’s impact at that same time. The date range I used to illustrate this was between 1875 and 1942 but, were you to pull it all out and dissect it, the common theme here is Neptune. From 1875 until about 1929, Neptune in Taurus- this is when the US saw its money situation struggling which lead to those issues I mentioned there in the later 1880s. Well, the next bunch of dates: Neptune in Leo, 1915 through 1929, which, if you know your history, the 20s were a time when, economically, the country was experiencing a nice boom. The Roaring 20s were called that due to the relative jubilation of the people, but the economy had gotten better due to WW1. The US captured a lot of the European market. Factories had increased production to rise to the demands of the war, and when it was over, those countries that had been open to importing goods from the US continued to. The then Republican government increased taxation on foreign goods in 22 and this lead to US-based businesses doing much better.

And again, if you know your history, the last date range is pretty obvious: from 1929 through 1942, what was going on? The US stock market crashed, unemployment and overproduction rose, merged with underconsumption and debt, and we went into the Great Depression. Though there are a ton of theories out there as to why it happened, one common thread is that the Federal Reserve didn’t handle things as they should have. (I could also go into just who the US was loaning money to and to what ends, but that’s another conspiracy altogether. Related, but, anyway.) Then, in 1941, World War 2. So just for this snippet of time, we had Neptune in Taurus, Neptune in Leo, and then, Neptune in Virgo. Going further back and further ahead, a pattern is made clear: when Neptune moves through Earth signs, the economy does not fare well. (Among other things) When it’s in Fire signs, it does well, but we can go into some of why it does at another time. I’m just establishing the pattern I see.

Continuing with this pattern, Neptune is currently in Pisces, where it has been since 2011, and it will be there until 2025 when it moves into fire sign Aries. Some believe that the very fact that it is in the last sign of the zodiac is pretty significant, and I am inclined to think so, too. And, going by that pattern established, this does mean that around that time, we should see a period of inflation where things get better, followed by another dip in 2039 where they get crappy again as it moves into Taurus.

Next time, I am going to go into how Pluto in Capricorn, which transitions into Aquarius in 2024 plays into this, and what this means in the meantime, between now and 2025. I hope you’ve enjoyed this exploration into the astrology of the Federal Reserve, and next time, we’ll go more into how that impacts things in the here and now a bit more fully, too.